AKA Last Week's Big Week in Tech

Last week, we had Mark Zuckerberg laying off 11,000 Meta employees. Elon Musk starting to deploy the new changes as the new owner of Twitter. The crypto exchange FTX collapsing under Sam Bankman-Fried's (SBF) house of cards leadership. Those are just the Top 3 from last week's headlines. It's truly an astounding time to be alive, especially if you, like me, are also living in the world of tech.

As these have been overly discussed on social media, I want to try and spin it into a positive. Because surely, it's not all bad.

What We Learned

On Layoffs

Last week started with the dreaded layoff news that was leaked over the past weekend. Since Monday, it has been the talk of the town. My friends who work at Meta were posting about how eerie and quiet their office has been. Mind you, this was just a week after Elon's Twitter laid off half of their workforce.

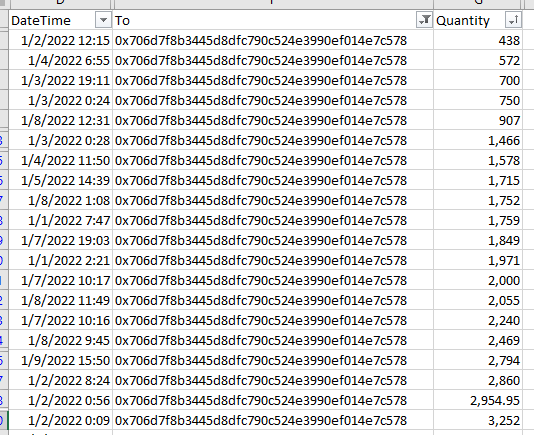

Tech Layoff

— Deedy (@debarghya_das) November 14, 2022

Meta - 11k (13%)

Twitter - 3.7k (50%)

Intel - 20%

Snap - 20%

Netflix - 450

Robinhood - 30%

Stripe, Lyft - 13%

Salesforce - 2k

Amazon - 10k

120k+ layoffs. 2000-01 dot com layoffs were ~107k. Q4 layoffs have just begun.

A brutally cold tech winter is coming.

The good was very evident also in social media. At least on my network, #MetaLayoffs was trending on Linkedin and I saw a lot of community super-connectors, like my friend Andrew, quickly respond with resources to help laid-off people find new job prospects. And to those who can't directly help, a lot have shared their network simply through boosting the message by commenting or sharing the posts.

Within these week after week of global layoffs, it's also grounding to know that our jobs can be taken away so quickly. Personally, these events made me ponder on previous experience of being funemployed and what I did then. It also got me to reflect on what I need to do if this happened to me. Thankfully, I'll be a little bit more prepared this time than I was five years ago.

On New Twitter

I don't own any Twitter shares so I'm literally not invested in this buyout. But after a decade of being a Twitter user, I would say that it has been long-overdue to shake things up over at Twitter.

The stock barely grew over this same decade. The most groundbreaking thing to ever happen would be getting the word count update from 140 to 280 characters five years ago. Apart from that, it has become a really stable but also stagnant social media company. And while constant change is not a great user experience, it also halted innovation.

One of the new changes that Mr. Musk swiftly enforced was allowing the common person with $8 to purchase the right to have a blue checkmark every month.

To the uninitiated, the blue checkmark was once a status that was awarded to artists, celebrities, politicians, journalists, etc. As public personalities, they needed to go through a vetting process to ensure that they were the same person being represented by the Twitter account. Once verified, they get a blue checkmark.

When it became a paid commodity recently, Twitter users did what they always did--have fun on the internet.

The biggest immediate casualty was the pharmaceutical company Eli Lilly when a fake Eli Lilly profile with a blue checkmark tweeted that insulin is now free. Then came a flood of fake profiles with the same status as official accounts. And then closely followed by the memes.

|

| Screenshot of the now-deleted tweet from the fake Eli Lilly account @EliLillyandCo on Twitter |

Of course there were real-life repercussions like the entire pharma industry tanking on the stock market but as (real) Bernie Sanders mentioned in his tweet, really what Eli Lilly should be apologising for is not the fake account that plunged the stock but rather making people pay $275 for a unit of insulin that costs less than $10 to make. And I must say: yasss Uncle Bernie! The entire week was all a bunch of funny memes with a lot of necessary commentary as such.

I would be remiss to not mention that Twitter Spaces, aka Twitter's almost copy of Clubhouse (allegedly), has been a great resource throughout my self-dubbed Tech Olympics. It's an exciting world to witness round-the-clock citizen journalism--quite literally, the broadcast went on for 3-4 days, don't quote me on that--and getting big hitters of the industry just casually pop by to talk about the developing story on FTX.

It's akin to having all the Late Night hosts do a marathon show and having various celebrities drop by to be interviewed for something not everyone cares about, like their take on NYC bagels.

On FTX Death

Speaking of the FTX being discussed on Twitter Spaces... I, along with tens and thousands (if not hundred thousands combined) of people tuned in to the coverage of Mario Nawfal on the decline of FTX via this avenue. At one point, it was just playing in the background for five hours while I was sick and resting in bed.

Executives of other crypto companies, FTX insiders and former employees, regulators--they all went and took the stage to discuss the unfolding events. It was so live that while discussions were happening, no matter who they were and how many millions/billions they have, they will get interrupted mid-speaking so Mario can announce the Breaking News being delivered to his DMs, after his staff has vetted the news, of course.

At some point the CEO of Binance Changpeng Zhao 'CZ' and even Elon Musk himself joined Mario's Twitter Space broadcast.

So why was this news so important?

It's because FTX was the second largest cryptocurrency exchange in the world, at least until last week. When FTX's entire foundation as a supposed centralised exchange got unveiled to be a scam, the bank run started. Institutions and retail investors alike had to rush into either selling their assets and then cash out, or even simply withdrawing their assets into wallets. More than a billion dollars of customer funds vanished out of thin air, and the value of the Exchange went from $30B to near-zero very quickly.

In cases like this, it's hard to find a silver lining when so many people's hard-earned money were knowingly stolen. I empathise and sympathise with everyone who are hurting from all this. On top of that, it worsened the already downward trend of all the currencies and tokens, and at the same time will make it harder for the mass public to adapt into the technology sooner.

If there's anything good that came out, it's really cementing the value of compliance for an extra volatile asset like cryptocurrency and the instilling the security that self-custody brings. Not your keys, not your crypto.

%20(1080%20%C3%97%20950%20px).png)