Passive Income through Staking Rewards on Flexa Capacity

January 11, 2022There have been countless posts on how to stake your AMP Token on Flexa Capacity but I wanted to share my experience for new crypto joiners to see how easy this process was on a Gemini Exchange user perspective. I did the entire thing on my iPhone.

1. Gemini Earn Redemption

1. Gemini Earn Redemption

Since I started buying AMP last February, I've been stacking them into Gemini Earn. I didn't want to bother with gas fees and I was contented with the then 1.7% interest rate. A few months ago, the Earn interest rate went down to 1.25% and while it wasn't a significant decrease from the previous rate, I felt like my AMP could be passively earning more.

To take advantage of the dip, I bought some ETH for gas. Then, I redeemed my bag from Gemini Earn. Pleasantly surprised at how quick the Gemini Earn Redemption -> Gemini Portfolio was. Usually it will take up to 5 business days for other coins/tokens. I was fully expecting to wait 5 business days for my Amp to be redeemed, but it was instantaneous. My AMP was in my Portfolio the moment I clicked on Redeem.

The perks of having liquidity for Gemini on Flexa Capacity. Also proof of Flexa collateralisation at work, using AMP tokens staked in the Gemini pool.

2. Gemini to Metamask

2. Gemini to Metamask

As always, Gemini to Metamask wallet is straightforward and most importantly free because Gemini covers the gas fees up to *n transactions. I initiated ERC-20 Withdrawals for both ETH (for eventual gas fees) and my bag of AMP.

Looking at the transaction hash, this took 30 seconds for all the confirmations to complete.

*I put n because this number seem to have changed. Before it was 20 free transactions, then some are saying 5. Some are saying 10. I know I have done more than five Gemini->Metamask transactions this month alone, and I didn't get charged any fees.

3. Metamask to Flexa Capacity

3. Metamask to Flexa Capacity

Right now there are three staking pools on Flexa Capacity: The Gemini pool (2.38% APY), the SPEDN pool (4.15% APY), the Lightning pool (4.52% APY).

Basically, these are staking pools where each application/network gets liquidity from. It's what enabled me to redeem my corresponding AMP tokens into my Gemini Portfolio without taking 5 business days and what allowed to collateralise my crypto purchases using the Gemini Pay feature as shown here.

The SPEDN pool provides liquidity to the crypto purchases done via the SPEDN app. Right now, there are a gamut of cryptocurrencies that can be spent in actual, physical shops like Bed Bath & Beyond, Gamestop ($GME), Nordstrom and Nordstrom Rack, Petco, Dunkin' Donuts, Coffee Bean & Tea Leaf and so many more.

Apart from retail shops, banks like Banco Agricola is now on the SPEDN app as a merchant too. This means El Salvadoreans can now pay/deposit crypto into fiat directly to their bank using the Flexa Network via the SPEDN app.

Lastly, the Lightning pool is the network used by apps using Bitcoin. The biggest "customer" of Lightning is El Salvador--a whole country that decided to allow Bitcoin as legal tender. This means every El Salvadorean can now pay and accept payments in Bitcoin for goods and services using their digital wallets, all powered by the Lightning network which the Flexa network provides the liquidity for.

Going back to the Staking Steps

I tried to check gas fees last night, only to see it going up to $70-$90 so I thought it would be better to sleep and do it in the morning.

Then I woke up at 6am, surprised that gas fees were even more expensive than last night. It started at $80. Several refreshes on my Metamask iPhone app later, it went down to $61 and I just grabbed it. Etherscan is telling me this took 30 seconds to fully process staking to the Lightning Pool at 4.52%, a good x3 from my Gemini Earn interest rates.

Now, I'm fully staked and has started earning AMP.

Some Takeaways

Some Takeaways

- As a heavy Fantom and Matic network user, I think Ethereum gas fees is really a joke. But since I wanted to get it done, I just paid the gas. That said, the high gas fees is also a good barrier for people not to Unstake from their pools. I think that's important when the rest of the crypto market is panicking during dips.

- The Flexa Capacity 'Connect to Wallet' feature needs work. Every time I refresh the page, it always asks me to Connect to Wallet. In most DeFi apps I have used, it will automatically connect you to the wallet because the Approval has already been done initially. As it is now, it takes a lot of steps on mobile to stake, especially when we're waiting for gas fees to go down a little bit before hitting Approve. (Read: Every website refresh on Mobile requires that you Connect to Wallet again, then select the Staking Pool and AMP quantity all over again)

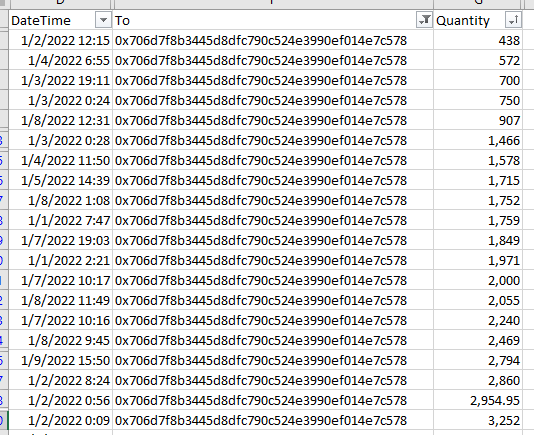

- Out of curiosity, I checked the AMP Token contract and saw that the Top 20 staking transactions (sorted in Ascending AMP quantity) is going from 438 AMP to 3,252 AMP. My first thought was "wow, how much in gas fees did they spend on this?" My second thought was "if they can stake such low AMP quantity and pay the same high gas fees, why tf did I wait so long to stake my bag?"

|

| Lowest 20 staked AMP transactions for January 2022 (sorted in Ascending AMP quantity) |

0 comments